Discover How Much You Need To Live Comfortably In Retirement

Discover How Much You Need to Live Comfortably in Retirement

I. Introduction

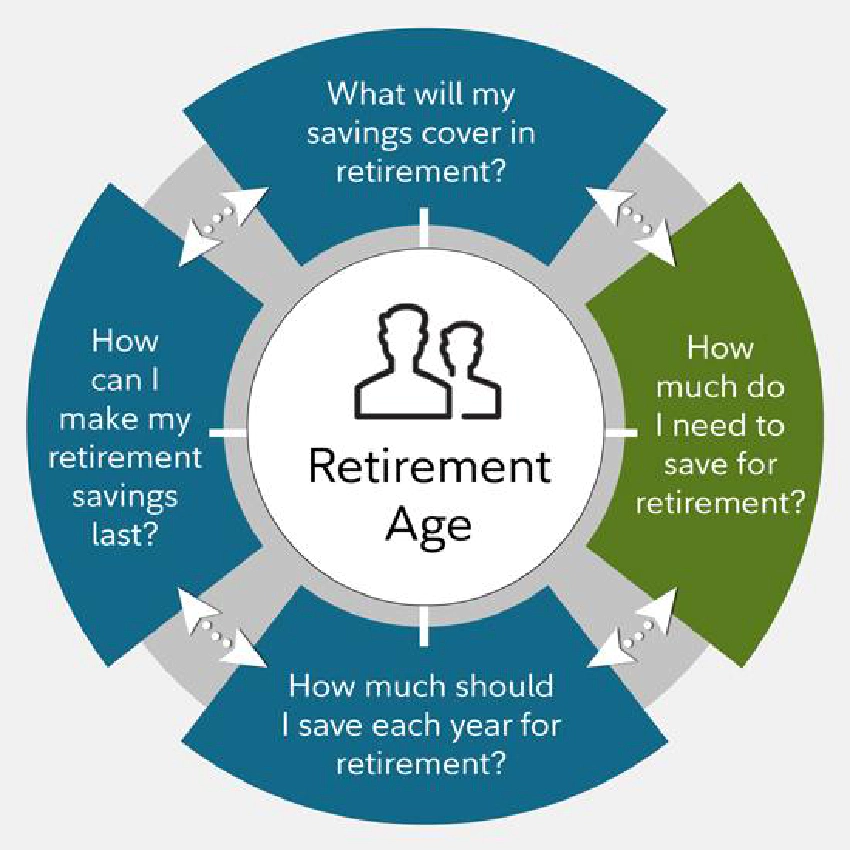

I. Introduction Retirement is an exciting time of life. It is a time for new beginnings and the chance to do things you have always wanted to do. However, it is also a time when it is vital to manage your money correctly. Knowing how much you need to save for retirement is one of the most important steps in securing your financial future. This guide will help you understand how to manage your retirement funds and how much you need to save in order to live comfortably in retirement. It will also provide tips on how you can increase your savings and make your retirement funds go further. By understanding the basics of retirement planning, you can ensure that you have enough money to live comfortably in retirement and make the most of your retirement years. This guide will help you get started and provide the tools and resources you need to make informed decisions about your retirement. So, let’s get started on discovering how much you need to live comfortably in retirement!

II. Definition of Pension Salary

Pension salary is the amount of money received as a retirement benefit from a company, government, or other organization. It is typically a set amount that is paid out on a regular basis throughout the individual’s retirement. For example, someone who has worked in the same job for many years and has a pension plan will receive a set amount of money each month to help provide financial security. Pension salaries can be an important part of retirement planning. Calculating the amount needed to live comfortably in retirement requires an individual to consider all sources of income, including pension salary. Knowing the estimated amount of pension salary income can help individuals plan for other expenses, such as housing, health care costs, and other retirement expenses. The amount of pension salary will depend on the type of pension plan. For example, a defined contribution plan will have a different amount of pension salary than a defined benefit plan. Understanding the differences between these types of plans can help an individual determine the amount of pension salary they will receive. Additionally, retirement age, years of employment, and other factors can impact the total amount of pension salary. It is important for individuals to understand these factors and consult with a qualified financial planner to ensure that their retirement needs are properly met. Overall, pension salary is a key part of retirement planning. Knowing the estimated amount of pension salary can help individuals plan for their retirement and make sure that they have enough income to live comfortably.

III. Factors to Consider When Determining a Good Pension Salary

When deciding what retirement income is enough to live comfortably, there are a few key factors to consider. One important factor is your pension salary. You want to make sure that it covers the cost of your essential needs, such as housing, food, transportation and healthcare. You should also include discretionary expenses such as entertainment, travel and hobbies. Another factor to consider is taxes. Make sure your pension salary is enough to cover any taxes you may have to pay in retirement. You should also consider inflation, as prices may go up over time. The age at which you plan to retire is also an important factor. The earlier you retire, the lower your pension salary will likely be. You should also consider whether you wish to continue working in retirement, which may bring in additional income to help supplement your pension salary. Finally, you should think about the type of lifestyle you want to live in retirement. Is your pension salary enough to cover the cost of this lifestyle? If not, you may need to look at other retirement income sources such as investments, part-time work and Social Security. When determining a good pension salary, it is important to consider all of the factors mentioned above. This will help you determine the amount of income you need to live comfortably in retirement.

IV. Different Types of Pension Salaries

There are many different types of pension salaries you can choose from when planning for your retirement. Depending on your financial situation and goals, one type may be better suited to your needs than another. Defined benefit pensions, also known as traditional pensions, are the most common form of retirement plan. They typically pay a fixed benefit every month, based on your pre-retirement salary, years of service, and other factors. Defined contribution pensions are a newer form of pension salary, where employers and employees both contribute a certain percentage of their salary each month. When you retire, the contributions plus any interest and investment gains are used to buy an annuity that produces a regular income for life. Hybrid pensions combine characteristics of both defined benefit and defined contribution pensions. They typically have a guaranteed benefit from a defined benefit plan, plus an additional contribution from a defined contribution plan. Finally, you may be able to supplement your pension salary with additional investments such as stocks and bonds, or a combination of investments. This can help provide additional income for your retirement. No matter which pension salary you choose, it is important to plan ahead and make sure you will have enough income to live comfortably in retirement.

V. Pros and Cons of a Pension Salary

A pension salary is a great way to ensure a comfortable retirement. It provides a steady stream of income and can help cover basic living expenses. However, it’s important to consider the pros and cons before deciding if a pension salary is right for you. The first pro of a pension salary is that it can provide a steady income for life. You can count on it to help pay for your essential expenses, and you won’t have to worry about any sudden changes in your income. Another pro is that you don’t have to worry about outliving your money. The pension salary will continue to provide funds even after you pass away, so you can leave a legacy for your family. On the other hand, a pension salary does have some downsides. It can be difficult to predict how much money you’ll need in retirement, so you may end up not having enough to cover all of your expenses. Additionally, inflation can reduce the buying power of your pension, meaning you may need to find other sources of income in order to support yourself. Overall, understanding how much money you need to live comfortably in retirement is important. Be sure to consider the pros and cons of a pension salary before making your decision.

VI. Conclusion

VI. Conclusion Retirement is an important milestone in life, and knowing how much you need to live comfortably is essential for planning for your future. Everyone’s retirement goals and lifestyle needs are unique, so you should consider all the factors involved before determining a retirement budget. It is important to factor in income sources, inflation, healthcare expenses, and lifestyle choices when budgeting for retirement. Make sure to create a retirement plan that covers all of these needs so that you can enjoy a comfortable retirement and avoid financial insecurity. Although it can be challenging to plan and save for retirement, it is essential for achieving the retirement lifestyle you desire. Start planning for retirement as early as possible and remember to stay on top of your retirement progress. With careful planning and dedication, you can enjoy a comfortable retirement without having to worry about money.

1. How much money do I need to retire at age 55?

Retiring at age 55 can be an exciting prospect, but you’ll need to make sure you have enough money set aside to live comfortably. Many people underestimate the cost of retirement and overestimate their ability to live off the money they have saved. It can be difficult to determine exactly how much money you need to retire at age 55, but there are several tools and resources to help you determine a realistic figure. First, consider your current lifestyle. It is important to have a good understanding of how much money you need to live comfortably now. This can be a good starting point to figure out how much you will need in retirement. Consider any changes you envision making in retirement, such as downsizing, moving to a less expensive area, or changing your lifestyle. Next, you should estimate how much money you will need during retirement. This includes income from Social Security, pensions, and your savings. Be sure to consider the cost of housing, health care, food, and other essential expenses. You may also want to factor in the cost of leisure activities, travel costs, and entertainment expenses. It is important to remember that your income may change over time, so it is wise to plan for unexpected expenses. If you have retirement investments, be sure to factor in inflation. If you need additional funds, consider taking out a retirement loan or working a part-time job. Finally, be sure to consult with a financial advisor who can help you accurately estimate how much money you will need to retire at age 55. They can provide you with advice and resources to help you plan for your retirement goals. Knowing how much money you need for retirement can help you make a plan to achieve the retirement lifestyle you desire.

2. What are the benefits of having a good pension salary?

Having a good pension salary is incredibly important when planning for retirement. It can provide you with the financial security you need to live comfortably and maintain your lifestyle. A good pension salary helps you save enough money to meet your retirement goals, such as paying off debt, upgrading your home, and traveling. It also allows you to cover unexpected expenses and still have enough money for day-to-day living costs. Having a good pension salary also helps you stay on top of inflation, since it rises with the cost of living. This ensures that your money retains its value and that you can continue to live comfortably in retirement. Having a solid pension salary also gives you more control over your retirement savings. You can decide how much to contribute to your pension plan each year and can adjust your contributions accordingly. This allows you to save more money and get the most from your pension plan. Finally, a good pension salary can give you peace of mind. Knowing that you have a reliable retirement income allows you to enjoy your retirement and all the things it has to offer. With a good pension salary, you can take control of your retirement and ensure that you have the financial security you need to live comfortably in retirement.

3. What investments should I make to ensure I can retire at age 55?

Retiring at the age of 55 can be a great goal to work towards. To ensure you have enough money to live comfortably, you should start investing early and regularly. A diversified investment portfolio is key. Consider investing in stocks, bonds, mutual funds, real estate, and other assets. Investing in a retirement account, such as a 401(k) or IRA, is a great way to save for retirement. It’s also important to consider other sources of retirement income, such as Social Security, pensions, or a part-time job. Finally, make sure to review your investments periodically and adjust your portfolio as necessary to ensure it’s meeting your goals. With the right investments, you can retire at 55 with confidence and financial security.

4. What strategies can I use to maximize my pension salary?

If you want to maximize your pension salary in retirement, there are a few strategies you can use. First, try to save as much as possible during your working years. Automate your savings so that you are contributing to your retirement fund on a regular basis. Second, make sure you invest your money wisely. Consider a diversified portfolio that includes stocks, bonds, and low-risk investments. This will help you maximize your potential gains while minimizing losses. Third, consider purchasing an annuity to supplement your pension. This can provide a steady stream of income throughout your retirement, allowing you to enjoy a comfortable lifestyle without having to worry about outliving your money. Fourth, think about using tax-advantaged accounts to save for retirement. These accounts, such as 401(k)s, IRAs, and Roth IRAs, can help you maximize the tax savings you can get from your retirement savings. Finally, don’t forget to plan for inflation. Prices will go up as you get older, so make sure you are saving enough for retirement to keep up with the cost of living. By carefully planning for your retirement, you can maximize your pension salary and live comfortably in retirement.

5. What types of retirement accounts should I use to save for retirement at age 55?

Retirement can be a difficult period to plan for, but it’s important to start early. At age 55, you need to think carefully about how to best save for retirement. There are many types of retirement accounts available, such as 401(k)s, Traditional and Roth IRAs, and annuities. Each of these accounts has its own advantages and disadvantages, so it’s important to research each option and make an informed decision. 401(k)s are employer-sponsored retirement accounts that allow you to save pretax money. Traditional IRAs also let you save pretax money, but have stricter contribution limits. Roth IRAs, however, allow you to save after-tax money and have more generous contribution limits. Finally, annuities are insurance-based investments that provide a steady stream of income for a set period of time. No matter which type of retirement account you decide to use, it’s important to start saving early and make consistent contributions. That way, you can start building your nest egg and enjoy the benefits of having a comfortable retirement.